IRS Form 940: Printable PDF for 2023

New Updates

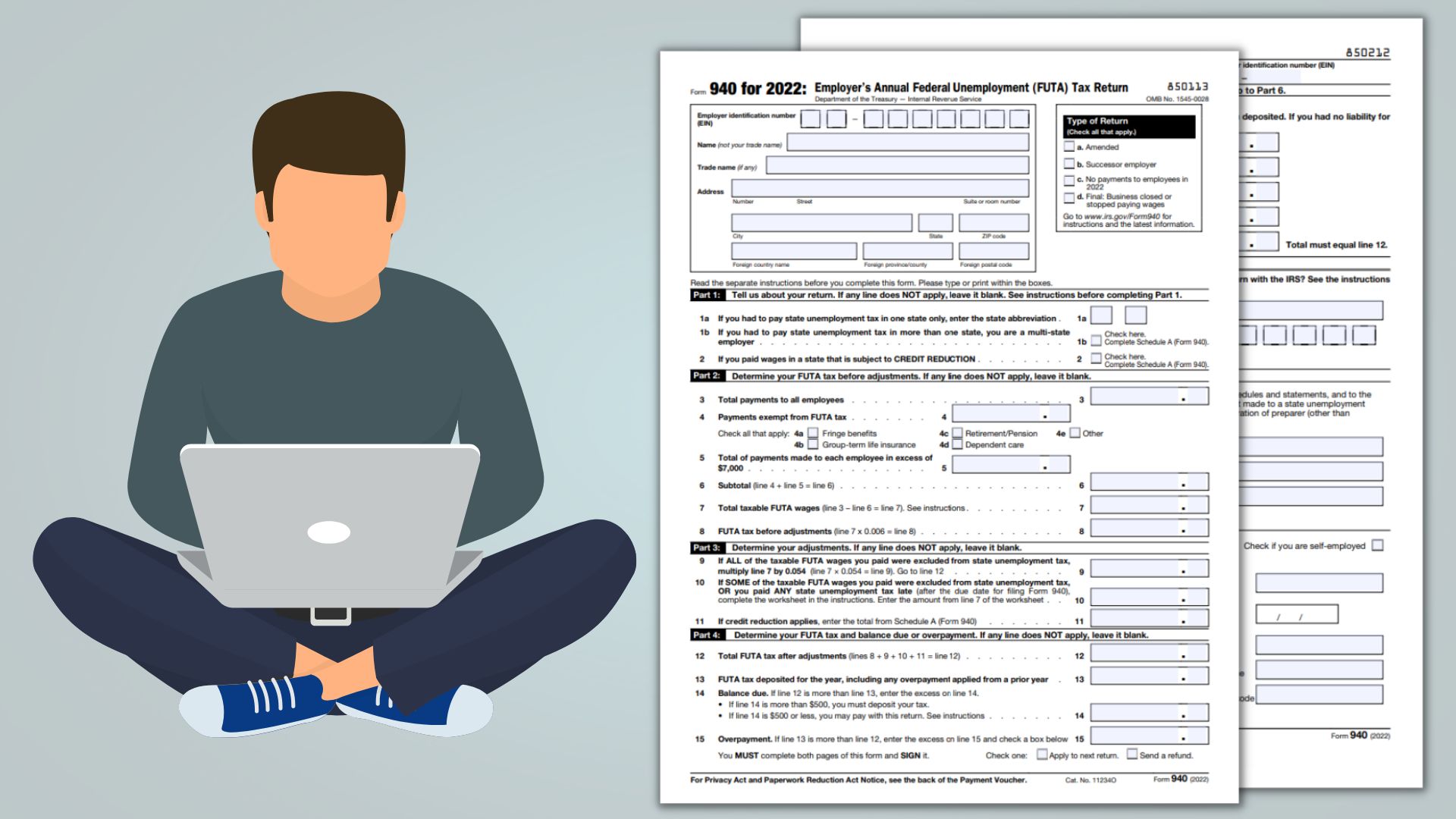

Fill Out Tax Form 940 for 2023 Online

Fill NowFederal 940 Tax Form: How-To Guide for 2024

Navigating employer fiscal obligations can be complex, but understanding IRS tax form 940 is an essential part of this process. Officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, it plays a pivotal role in how businesses report their yearly Federal Unemployment Tax Act obligations. The primary purpose of the federal Form 940 is to calculate and report the amount of unemployment tax an employer must pay for their employees, which ultimately funds state workforce agencies.

Employers are responsible for paying unemployment taxes on the first $7,000 earned by each employee in a calendar year. It's critical to note that while the FUTA tax provides funds for state unemployment agencies, it is not deducted from employee wages. Instead, it is solely an employer-paid tax.

Our website, 940-form-irs.com, is a valuable resource for employers seeking assistance. It accommodates many materials that simplify the printable IRS Form 940 completion. Among the resources provided, instructions for Form 940 are available to elucidate each step, ensuring accuracy and compliance with federal regulations. This guidance helps employers determine their FUTA tax liability, catering to various situations, such as exempt payments and special credits that may affect the total amount due.

Overview of Federal Form 940

Navigating the domain of employer fiscal responsibilities often culminates in discussing a critical document – the Federal Unemployment Tax Act (FUTA) return. This return is a pillar in the tax system, specifically tailored for reporting annual federal unemployment taxes. Employers are responsible for reconciling their unemployment tax liabilities through IRS Form 940 for 2023, ensuring appropriate funding is channeled toward supporting the unemployed workforce.

The mandate for filing federal tax form 940 encapsulates a spectrum of business entities. Most employers who pay wages exceeding $1,500 in any quarter or have had an employee work for a part of a day in any 20 or more different weeks in the year are obligated to print the 940 form and submit it on time. The IRS delineates the exact criteria and exceptions, highlighting that adherence is not solely predicated on the presence of a large workforce. Instead, the broader reach incorporates even those with smaller teams but consistent employment patterns.

The document should be used by businesses preparing their filings for the previous year. Companies must source the updated document to capture any revisions in tax legislation or reporting mechanisms that may influence their fiscal obligations.

For those inclined towards efficiency and ease of access, we offer the convenience of obtaining Form 940 for 2023 in PDF format directly from our website. This digital version can be downloaded, filled out electronically, and printed for record-keeping purposes or if a paper submission is preferred.

When it comes time to print IRS Form 940, employers should ensure their printers are set to output the copy in clear, legible quality. Submitting a hard copy that is difficult to read could lead to processing delays or errors in evaluating their tax filings.

Calculating FUTA Tax on Form 940

Understanding the intricacies of the 940 FUTA tax form for 2023 is essential for employers who pay wages to employees. Businesses must submit this accurately to avoid potential penalties and ensure compliance with federal regulations.

- When preparing to fill out IRS Form 940, it's crucial first to get a clear picture of the FUTA tax rate. As of the time of writing, the FUTA tax rate is 6.0% on the first $7,000 paid to each employee annually.

- However, employers can often receive a credit of up to 5.4% against this tax if they've paid state unemployment taxes in full and on time. This potential credit reduces the effective FUTA tax rate to 0.6%.

Calculating the FUTA tax liability is fairly straightforward once you understand the framework.

- First, calculate the total wages you paid to your employees for the year.

- Then, identify which portion of those wages falls under the taxable wage base – meaning, only the first $7,000 paid to each employee within the year is considered for FUTA taxes. Any amount beyond that is not subject to FUTA taxation.

- Once you have determined your taxable wages, apply the 6.0% FUTA tax rate to these wages, then subtract any qualifying state unemployment tax credits from this figure to determine your FUTA liability.

- Remember that various factors may impact your qualification for credits, thus affecting your liability.

Completing IRS Form 940 in PDF requires attention to detail and an understanding of the applicable tax laws. So, it's beneficial for employers to familiarize themselves with the Form 940 example and instructions or seek professional assistance if clarification is needed. Remember, being accurate and timely when addressing the 940 printable form for 2023 is critical to maintaining compliance and preventing possible discrepancies with the Internal Revenue Service.

Understanding the FUTA Tax

Navigating the complexities of business taxation requires a thorough understanding of various forms and deadlines associated with them. An essential piece often faced by employers is the 940 FUTA form for 2023.

Firstly, an overview of the deadlines for filing the 940 form template is imperative. The IRS mandates that employers must submit this document by January 31st of the year following the reported tax year. For instance, the due date for the IRS 940 form for 2023 will be January 31st, 2024. Should this date fall on a weekend or public holiday, the deadline moves to the next business day. For those who have deposited all FUTA tax when it was due, the IRS may extend the deadline to February 10th.

Further to ensuring proper adherence to fiscal obligations, staying current with the schedule for depositing FUTA tax payments is essential. Businesses should make these tax deposits quarterly if their fiscal liability exceeds $500 within the calendar quarter. Deposit due dates are typically the last day of the first month following the end of the quarter. Hence, they would fall on April 30th, July 31st, October 31st, and January 31st for each quarter.

Today, streamlining submission processes is easier due to advances in technology. Employers are encouraged to file the 940 electronically, an efficient and environmentally friendly method. Through IRS-approved e-file providers, the process of submitting this crucial document is simplified, and verification of receipt is immediate.

The Common Errors on Form 940

| Common Mistakes | Tips for Accurate Reporting |

|---|---|

| A frequent error occurs when employers fail to complete all required fields on the blank 940 form accurately. | Ensure that every field on the template is filled out completely. If a section does not apply, enter '0' or 'N/A' as instructed. |

| Calculating Federal Unemployment Tax (FUTA) incorrectly can result in underpayment or overpayment of taxes. | Use the Form 940 instructions for 2023 to calculate the FUTA tax correctly, and double-check your math before filing. |

| Missing deadlines is another mistake with potential penalties. Employers often lose track of when to file Form 940. | Mark your calendar with the Form 940 due date, and consider setting a reminder one week before to avoid last-minute filing. |

| Errors in reporting state unemployment contributions can lead to discrepancies when reconciling records with state agencies. | Cross-reference state payments and ensure that they align with the information reported on your Form 940. |

| Employers sometimes neglect to keep updated records, which might lead to incorrect information when they print the 940 form for 2023. | Maintain meticulous payroll records throughout the year to provide accurate data when printing and filing your printable 940 tax form for the relevant period. |

| Not using the correct form version can lead to a rejected submission since tax forms are updated annually. | Always get the current year's template when seeking a blank 940 tax form to avoid using outdated documents. |

| Using an IRS Form 940 example as a reference is useful, but copying information directly from examples can introduce errors. | Review examples to understand the format, but input your business's tax information accurately. |

| Forgetting to sign and date the filled form is a common yet serious oversight that can result in processing delays. | Always review the completed form for required signatures and dates before submission to the IRS. |

| Not all digital formats are accepted by the IRS, so attempting Form 940 for download in an incompatible file type may cause issues. | Confirm the acceptable file types on the IRS website and ensure your Form 940 is in a compatible format before downloading. |

The 940 Form Importance for Businesses

When businesses begin preparing their annual financial documents, the 940 FUTA tax form emerges as a critical piece required by the Internal Revenue Service. Employers must diligently fill out the 940 form to report the amounts paid into state and federal unemployment taxes. The process may seem daunting, especially for companies with employees working across multiple states, which can complicate determining the appropriate state for unemployment tax reporting. However, companies can accurately fulfill their fiscal obligations with clear understanding and guidance.

The annual Form 940 is designed to calculate how much an employer owes in unemployment tax at the federal level, taking into consideration the state unemployment taxes already paid. It is important to note that if you have employees in more than one state or if you are paid wages in a state that has different FUTA tax credits, additional schedules may be necessary to complete your Form 940 (FUTA) accurately.

Determining the applicable state for unemployment tax reporting involves understanding the "four-factor test." This test helps establish a worker's primary state of employment based on four criteria: where the employee performs a majority of their work, where the employee is directed or controlled, where the employee has his or her base of operations, and where the employee resides.

When confusion arises over which state income should be reported for FUTA purposes, use these factors sequentially to conclude. If it's not clear after the first factor, move on to the second, and so on. The employer may need to report to multiple states if the four-factor test does not provide a clear answer.

Instructions and Tips to Fill Out Form 940 for 2023

To successfully fill out Form 940, a deep understanding of what is required is necessary. Employers must maintain detailed records of all employee wages throughout the year. This includes but is not limited to, documenting each employee's earnings, the date of every payroll period, and any FUTA tax deposits made. It is recommended that employers keep this information for at least four years after filing their payroll tax form 940 to meet the recordkeeping obligations.

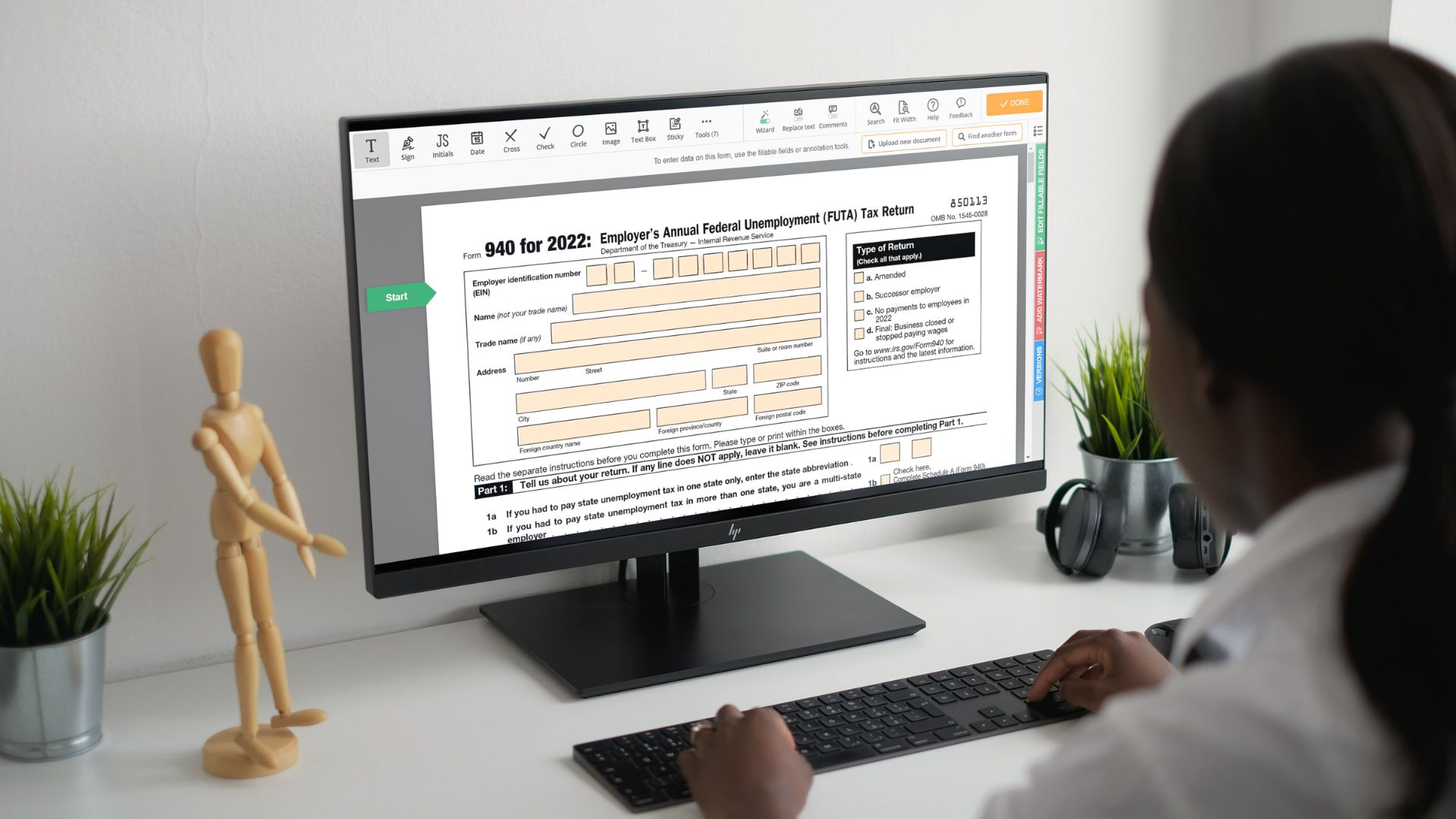

The process becomes more manageable with the advent of the 2023 940 tax form in PDF format. This digital form streamlines reporting as businesses can more easily access, complete, and store their forms electronically. The PDF version of the federal 940 tax form is especially beneficial as it ensures accuracy through fillable fields, reducing the margin for errors associated with manual entry.

Ways to File the 940 Federal Form

The federal 940 form for 2023 will require employers to disclose the amount of unemployment tax owed for every individual eligible for employment services.

For employers looking to streamline their filing process, there are electronic filing options that provide a multitude of benefits. The option to e-file the 940 offers the advantage of convenience, accuracy, and faster processing times compared to traditional paper filing. Electronic submissions through IRS-approved software are designed to reduce errors by checking for common mistakes before accepting the document. This ensures that the information provided is accurate and complete, mitigating the risk of delays due to inaccuracies.

Additionally, using a free fillable form 940 through the IRS's e-file system can be a cost-effective solution for businesses. By reducing the need for paper, postage, and manual handling, businesses save on administrative costs. Furthermore, instant submission confirmation is provided, giving peace of mind that crucial tax information has been received by the IRS.

For businesses ready to file Form 940 electronically, it is important to be aware of the specific deadlines and requirements to avoid penalties. The IRS encourages businesses to utilize the e-filing system due to its secure, reliable, and prompt service. Moreover, electronic records are easily accessible for future reference, ensuring that employers keep accurate records for several years as mandated by law.

The Due Date to File the 940 Tax Form to the IRS

Deadlines to file IRS Form 940 are consistent each year, allowing business owners to plan ahead. It must be submitted to the Internal Revenue Service (IRS) by January 31st for the previous calendar year's taxes. This deadline references both the physical filing of forms and accompanying tax payments. It's important to mark this date in your calendar, ensuring all relevant data is gathered well in advance to complete the 940 form accurately.

Timely submission is crucial; failing to file by the January 31st deadline can result in penalties. These can start from 5% of the tax due and increase monthly by 0.5% up to 25%. Should you foresee a difficulty in meeting this deadline, it's possible to file for an extension. To do so, you will need to submit a written application to the IRS before the deadline, detailing the reasons for your delay. However, it's critical to understand that an extension to file your return does not grant you more time to pay any taxes due.

The IRS offers the convenience of online filing, which is often faster and more secure. You can file the 940 online to the IRS by using authorized e-file providers, ensuring the process is handled efficiently and without the common errors of manual submissions. Remember that utilizing online services requires access to reliable internet and familiarity with the e-filing process.

While Form 940 is filed annually, keep in mind that it's important to maintain thorough records quarterly. Being diligent with your paperwork throughout the year will simplify the filing process come January. It is worth noting that the IRS 940 quarterly form is not required; it is a common misconception since FUTA taxes are paid quarterly. Proper understanding and management of the 940 payroll form can help ensure businesses stay compliant and avoid unnecessary penalties.

IRS Form 940: Recent Changes or Updates to FUTA Tax Laws

Recent revisions to tax law may impact the information required when completing this form. The Internal Revenue Service periodically updates its guidance, and it's incumbent upon employers to familiarize themselves with the latest 940 FUTA instructions from the IRS. These instructions often detail calculating the tax due, considering credits for state unemployment taxes paid, and outlining specific deposit requirements.

To streamline the reporting process, the IRS provides a standard Form 940 template, which can assist employers in understanding what information needs to be included and how to format their tax submissions properly. This template is a valuable guide to compiling the necessary data, such as the total amount of FUTA taxable wages paid to employees throughout the year.

Employers should be proactive in reviewing these materials as early as possible to ensure sufficient time to address any issues that may arise. By staying current with FUTA regulations, businesses can more effectively navigate tax season, ensuring no unexpected surprises related to printable Form 940 for 2023 filings. It is always advisable for employers who are uncertain about their tax situations to consult with a professional advisor who can provide individualized assistance tailored to their business needs.

Fill Out Tax Form 940 for 2023 Online

Fill NowAnnual 940 Tax Form (FUTA): People Also Ask

-

When is the deadline for filing Form 940 for the tax year?

The deadline for filing Form 940 is January 31st for the previous tax year. However, if you deposited all your FUTA taxes when they were due, you have until February 10th to file. Notably, the due date is typically the next business day if the deadline falls on a weekend or federal holiday. We recommend using the 940 fillable form to streamline the whole process.

-

Where can I find a 940 tax form example to guide me?

Users can locate an example on our website for a comprehensive understanding of how to complete the form. By studying a completed example, employers can gain clarity on the type of information required and the correct way to input their data. These examples serve as a practical guide to help circumvent common mistakes.

-

Can I file my 2023 Form 940 in PDF directly from your website?

Yes, our website provides a blank PDF file, which can be downloaded easily. Once you have the form, you must print it out, fill in the necessary information, and mail it to the IRS. Keep in mind that accurate completion is imperative to avoid potential issues with the IRS.

-

Is there an editable and fillable 940 form available online?

Yes, our website features a fillable PDF you can complete on your computer. This editable version simplifies the process as you can type in your information and print the completed form for your records and for mailing. It is a convenient option that saves time and reduces errors associated with handwriting information.

-

How do I obtain a blank Form 940 to start the filing process?

To download the 940 blank template, simply visit our website and click the "Get Form" button. This will give you immediate access to the form you need for the filing process. Remember to verify that you have the correct version of the form for the specific tax year you are reporting.

IRS 940 Form: Top 10 Essential Facts

IRS 940 Form: Top 10 Essential Facts